Board of

Directors

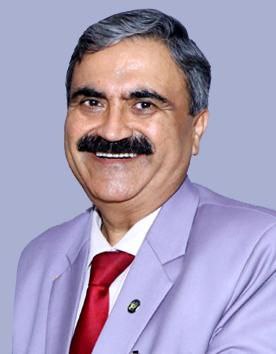

Shri. Gurumoorthy Mahalingam has had a professional career of more than four decades spanning across the financial sector regulators, the Reserve Bank of India (RBI), and the Securities & Exchange Board of India (SEBI). He has taken on varied roles in RBI encompassing financial market development, regulation and operations, foreign exchange reserves management, debt management, and regulation and supervision of banks. He was the Chief Dealer and Executive Director in-charge of forex market interventions as well as management of forex reserves of the country and rupee liquidity policy and operations. In the above roles, he was instrumental in formulating regulatory policies in respect of financial markets and the conduct of market operations of RBI. His experience spans across most difficult and volatile times in the financial markets, such as the Global financial crisis, European debt crisis (2011-12) as well as the taper tantrum (2013-2016). He was closely involved in giving shape to foreign exchange policies and monetary policy implementation.

In his role as a Whole-time Board Member of SEBI (between 2016 and 2021), which carried Executive responsibilities as well, he has had a wide experience regulating Mutual Funds, Stock exchanges, Listed companies, foreign portfolio investors, corporate governance aspects, stock and derivatives markets, corporate bond market, amongst others. He has supervised the conduct of investigations and enforcement actions in regard to violations of securities laws and regulations. He was a quasi-judicial authority for a little over 500 cases involving market misdemeanors. He is currently chairing the SEBI Advisory Committees on Secondary Markets and Corporate Bond Markets. While being in RBI and SEBI, he was associated with important committees in the area of forex markets, financial benchmarks, corporate bond markets, etc.

Mahalingam is currently an independent Director in the boards of the largest insurance company in India, a private sector bank, a pension fund, a credit rating agency, a depository, amongst others.

Mahalingam began his career as a commercial banker with the State Bank of India in 1978 after finishing his Master's in Statistics and Operations Research from IIT Kanpur. He is also an MBA in International Banking and Finance from the Birmingham Business School in the UK.

Shri Gurumoorthy Mahalingam is also on the board of the following companies and body corporates:

Director -Life Insurance Corporation of India

Director -City Union Bank Limited

Director -Care Ratings Limited

Director -India International Bullion Exchange IFSC Limited

Director -DSP Pension Fund Managers Private Limited

Director -Care Ratings Limited Nepal

Director -Thomas Cook (India) limited

Nehal Vora is the Managing Director and CEO of Central Depository Services (India) Limited (CDSL), India’s largest depository by number of demat holders and the only listed depository in Asia-Pacific region.

With close to three decades of experience in significant roles at BSE, DSP Merrill Lynch, and SEBI, Nehal has driven transformative growth at CDSL since September 2019, overseeing it become the custodian for over 15.29 crore demat accounts (as on March 31, 2025). His leadership also emphasizes financial literacy and investor awareness and his expertise in regulatory matters is evident from his significant contributions to SEBI advisory committees.

Previously, as the Chief Regulatory Officer at the Bombay Stock Exchange, he led initiatives in compliance and investigations. His career began at SEBI in 1996, where he pioneered derivatives innovations and key system implementations like the T+2 rolling settlement. His efforts at DSP Merrill Lynch earned him the OGC Living the Mission Award in 2008 and other efforts earned him recognitions such as the Distinguished Alumnus at H. R. College of Commerce and Economics, NetApp Innovation Award 2019, Compliance Champion award in 2018, amongst many others.

teams.

Nehal’s achievements have earned him numerous accolades, including the recent ‘Global Custodian Legend Award, Asia’, in May 2024, ‘CEO of the Year Asia’ by Asia Asset Management. Additionally, under his leadership, CDSL has received several prestigious awards such as the ‘Central Securities Depository of the Year’ at the Asset Servicing Times – Industry Excellence Award 2023, ‘Best Market Infrastructure Institution of the Year, 2024’, and the ‘Highly Recommended Market Infrastructure Institution of the Year’ in 2023 at the Regulation Asia Awards.

Smt. Rajeshree Sabnavis, a Chartered Accountant is founder of M/s. Rajeshree Sabnavis & Associates, specializes in transfer pricing (related party pricing), tax and regulatory advisory including transaction support and has over two and a half decades of experience in this field.

Smt. Sabnavis has worked with Indian Multinationals in the ITES sector in implementing their transfer pricing across jurisdictions including working on cross border restructuring and acquisitions.

Smt. Sabnavis has worked with some of the large portfolio investors investing in India including Institutional Investors in managing their tax compliance and litigation in India. She has also worked on the tax advocacy for some of the institutions in representing the general issues faced by investors with their investments in India.

Smt. Sabnavis is on the Managing Committee of the Bombay Chamber of Commerce one of the oldest Chambers of Commerce where she works actively with Members of the industry-on-industry related tax and regulatory issues.

A professional entrepreneur with an organizational mindset focusses on building teams placing high priority on governance.

She is also a certified Mediator having undergone the training conducted by the Indian Institute of Corporate Affairs.

Smt. Rajeshree Sabnavis is also on the board of the following companies and body corporates:

Director -BOB Capital Markets Limited

Director -Bombay Chamber of Commerce and Industry

Prof. Varsha Apte is a Professor in the Department of Computer Science and Engineering at IIT Bombay and served as the Head of the Department from May 2022 to May 2025. She completed her M.Sc. from Pune University in 1989, and PhD. from Duke University in 1994, both in Computer Science. After her PhD., she joined the Teletraffic Theory and Performance Analysis department in AT&T Bell Labs as Member, Technical Staff, which later became the Network Design and Performance Analysis department of AT&T Labs. She joined as faculty in the Computer Science and Engineering Department, IIT Bombay in 2002. During the academic years 2009-2011, she was on leave from IIT Bombay and Visiting Faculty at the Computer Science and Automation Department, Indian Institute of Science, Bangalore. While in Bangalore, she also worked at IBM Research Labs as part-time Visiting Researcher from June 2009-May 2010. From February 2016 to February 2019, she served as the Head of the Network and Computing Infrastructure department (called “Computer Centre”) of IIT Bombay. Her areas of interest are performance analysis of computing systems and networks and building applications for online programming education, including AI for programming education

Mr Bharat Vasani is a seasoned legal professional with over 40 years of experience. He has a rich experience in large corporates and was the Chief Legal & Group General Counsel of the Tata Group for around 17 years and retired from the Group as the Legal Advisor to the Tata Group Chairman. He was also on the Board of several listed and unlisted companies of the Tata Group. He presently also serves as the Public Interest Director on the Board of Central Depository Services (India) Limited and an Independent Director of Adani Total Gas Limited and Phoenix ARC Private Limited.

In his long stint at senior management levels, Mr. Vasani has successfully built and managed the in-house legal departments of large multinationals. He has steered several large and significant M&A transactions pursued by the Tata Group, including many successful cross-border deals. He has also successfully negotiated many joint ventures with various multinational conglomerates. Mr. Vasani has also extensively advised on complex commercial transactions involving nuanced legal issues on various aspects such as the related party transactions (RPT) regime in India, new CSR regime, schemes of arrangement, M&A, joint ventures, etc. and has also extensively advised on aspects relating to inbound and outbound investments and securities law. Mr. Vasani has a vast experience in advising clients on the SEBI LODR Regulations, including the recent amendments notified by SEBI.

Mr. Vasani’s influence extends beyond corporate practice into public policy, where he is highly regarded in government and industry circles. As the Chairperson of Legal Affairs Committee at the Bombay Chamber of Commerce and Industry, he has actively represented corporate interests before key regulators including the MCA, SEBI and RBI. His commitment to legal education and knowledge sharing is demonstrated through his participation in nearly 250 nationwide seminars, appearances on CNBC, and comprehensive training sessions for Board and Audit Committee members on corporate law and governance matters. He is a keen public speaker and was selected to speak on India’s Competition Act at the reputed Chatham House, London. He is a prolific writer and routinely shares his views on various contemporary aspects related to corporate governance, and other corporate law issues on different public fora. He was also a specialist editor of the 19th Edition of A Ramaiya's celebrated commentary on the Companies Act.

Mr. Vasani is presently a Senior Advisor – Corporate Laws at a leading law firm, Cyril Amarchand Mangaldas (CAM). In his role at CAM, Mr. Vasani has provided nuanced guidance to clients on strengthening their internal compliance, governance frameworks and advised on complex aspects of corporate and securities laws and crisis management. Mr. Vasani has also authored more than 100 blogs on a diverse array of topics ranging from company law, SEBI Regulations, FEMA, and corporate governance.

Shri Bharat Vasani is also on the board of the following companies and body corporates:

Director -Adani Total Gas Limited

Director -Phoenix ARC Private Limited

Director- Hero Future Energies Private Limited

Ms. Kamala K is the Chief Regulatory Officer heading the Regulatory functions of BSE encompassing Market Supervision, Member Supervision, Investor Service, Corporate Communication etc.

She has rich and diverse experience of around 38 years in the areas of Finance. She has been long associated with financial markets in general and MII space performing various roles. She has worked in multiple organisations like PFC, IIM-B, BgSE, BgSE Financials, Invest smart, NSE, Edelweiss Group. She has also been part of various reforms in capital market, actively participating in policy making through various Committees constituted by Regulators and stock Exchanges.

Sushri Kamala Kantharaj is also on the board of the following companies and body corporates:

Director – BSE Index Services Private Limited (Formerly known as “Asia Index Private Limited”)

Director -Indian Clearing Corporation Limited

Director -BSE Investments Limited

Chief Regulatory Officer - BSE Limited

Shri Rajesh Kumar assumed charge as Director of the North Zone Zonal Training Centre (NZ-ZTC) on April 10, 2023, bringing with him a rich and illustrious career spanning over 37 years in the Life Insurance Corporation of India (LIC).

A distinguished 16th Batch Direct Recruit Officer, he began his journey with LIC in 1988 and rapidly rose through the ranks, becoming a Branch Manager in 1992.

Throughout his tenure, Shri Rajesh Kumar has held several pivotal positions across the organization, including: Secretary (Marketing) for both Northern and Western Zones, Deputy Secretary (Corporate Communications) at the Central Office, Executive Editor of LIC’s esteemed house journal ‘Yogakshema’.

He is widely recognized for his dynamic leadership in Marketing and Training, with a proven track record of driving high-performance teams and achieving ambitious business goals. His passion for strategic marketing, sales training, and field motivation has left a lasting impact across zones.

A firm believer in people-centric leadership, Shri Rajesh Kumar is known for his mega honoring shows that brought glory to LIC, celebrated sports personalities, and iconic public figures to energize the field force, He is a veteran in public relation activities which boosted the morale and brought excellent business outcomes.

In his role as Regional Manager (Marketing/ B&AC), Central Zone, he created history by achieving the Annual Policies Budget in November—the first such feat by any zone in all India. As Regional Manager (CRM), Northern Zone, he steered the zone to All-India leadership positions with consistent growth across all key business metrics.

Currently, as Director of NZ-ZTC, Shri Rajesh Kumar is focused on transforming the training landscape. He has introduced innovative training modules, motivational sessions, and experiential learning formats tailored to build a future-ready workforce. His ability to link training with tangible marketing outcomes has been widely acknowledged.

Management Team

| Name | Designation |

| Shri Nehal Vora | Managing Director & Chief Executive Officer |

| Shri Amit Mahajan | Chief Technology Officer |

| Smt Nayana Ovalekar | Chief Regulatory Officer |

| Shri Girish Amesara | Chief Financial Officer |

| Shri Rajesh Saraf | Chief Data and Operations Officer |

| Shri. Vinay Madan | Chief Risk Officer |

| Shri Nilesh Lodaya | Chief of Business Development & New Projects |