Issuance Of Duplicate Securities

SIMPLIFIED PROCESS FOR ISSUANCE OF DUPLICATE SECURITIES

Are you a Niveshak (Investor) who has lost or misplaced your Physical Share Certificates? Worry Not! Our simplified process ensures you can easily recover them without any hassle – Koi Shak?

Before we begin, please note that Duplicate securities shall be issued in dematerialized mode only, in compliance with SEBI regulations.

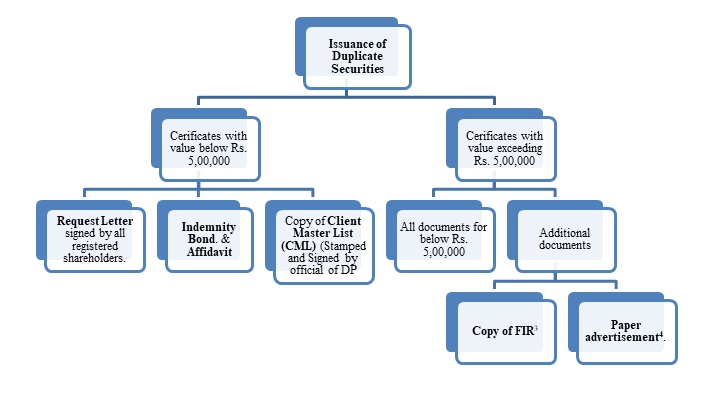

Issuance of duplicate securities are classified in to two categories as per value of securities as on application date. Following documents are to be submitted :

Things to remember:

1. Both Indemnity and Affidavit should be Notarized.

2. Time period for issuance of Letter of Confirmation is 30 days from the date of receipt of final documents by the Company/RTA.

3. FIR (Police Complaint) SHOULD contain

- name of all the Registered shareholders with lost/misplaced certificate details (Face value of shares, Registered Folio No(s), Certificate and Distinctive Nos. and number of shares).

- Paper advertisement w.r.t. the misplaced/lost shares in one widely circulated newspaper.

Process:

Step 1: Prepare Essential Documents mentioned above to ensure the issuance of duplicate securities, gather the necessary documents:

Step 2: Submit Documents to the Company:

Submit all required documents to the Company, which will then forward them to the Registrar and Transfer Agent (RTA). This ensures a seamless and organized process.

Step 3: Receive Letter of Confirmation:

Within 30 days from the receipt of the final documents, the RTA or the Company will issue a Letter of Confirmation. This letter is a crucial validation of the process and a signal that your request is progressing smoothly.

Step 4: Demat Request Submission

To finalize the process, submit the Demat Request Form through your Depository Participant (DP) within 120 days of receiving the Letter of Confirmation. Failure to do so within the stipulated time will result in the securities being credited to the "Suspense Escrow Demat Account" of the company.

Step 5: Securities Credited to Demat Account

Once the Demat Request is successfully processed, the securities of the lost/misplaced certificates are credited to your demat account, ensuring a secure and hassle-free retrieval process.

Example:

- File an FIR (Had the value been less than Rs. 8,00,000 – this step wouldn’t be necessary)

- File a Paper Advertisement in a widely circulated newspaper

- A Request Letter signed by all registered shareholders.

- Indemnity Bond. & Affidavit

- Copy of Client Master List (CML) (Stamped and Signed by official of DP) to be submitted.

The Company along with the RTA, issued a Letter of Confirmation within 30 days.

Joshiji, timely as ever, submitted the Demat Request through his DP within 120 days, resulting in the successful crediting of his securities to his demat account.

REFERENCE: SEBI Circular No.: SEBI/HO/MIRSD/MIRSD_RTAMB/P/CIR/2022/70 dated May 25, 2022

https://www.sebi.gov.in/legal/circulars/may-2022/simplification-of-procedure-and-standardization-of-formats-of-documents-for-issuance-of-duplicate-securities-certificates_59173.html