Background

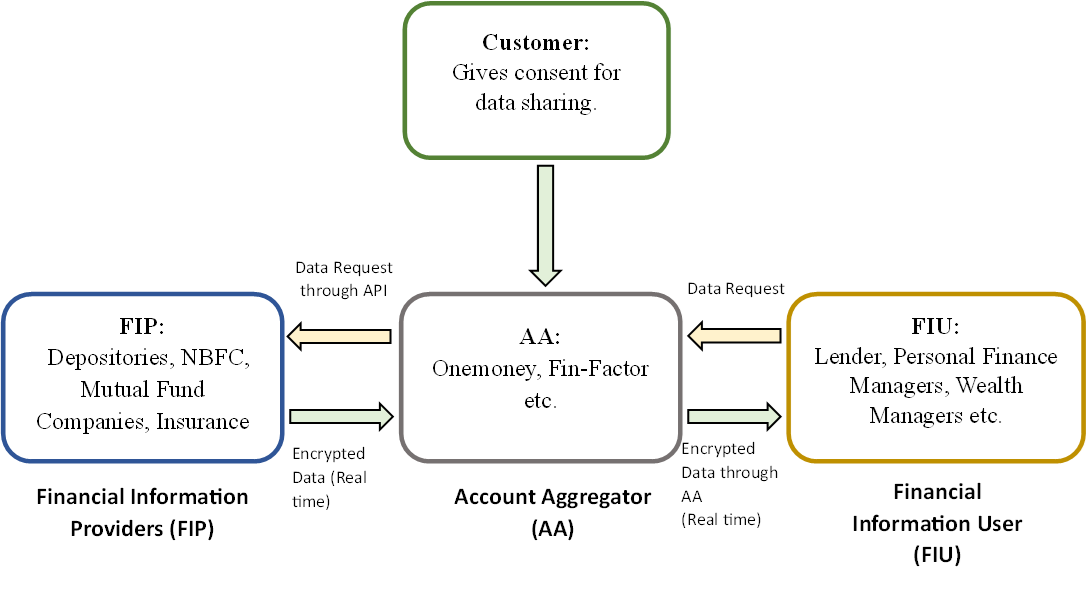

Account Aggregator (AA) is the connector between Financial Information User (FIU) and Financial Information Provider (FIP). The main purpose is to provide transparent information to users.

Financial Information Provider (FIP) are institutions that hold user data such as Depositories, banks, NBFCs that share customer’s financial information with Financial Information User (FIU) via requests through an Account Aggregator.

Financial Information Users (FIU) receive digitally signed data from Financial Information Providers (FIP) via Account Aggregators. FIU uses the data to provide various services to the consumer like loans, insurance, or wealth management.

SEBI CIRCULAR

SEBI CIRCULAR :

SEBI vide its Circular SEBI/HO/MRD/DCAP/P/CIR/2022/110 dated August 19, 2022 has allowed depositories to participate as FIP in the AA Ecosystem

https://www.sebi.gov.in/legal/circulars/aug-2022/participation-as-financial-information-providers-in-account-aggregator-framework_62157.html

CDSL as FIP

CDSL FIP through Account Aggregators shares the information about securities held in the CDSL demat account with the customers and Financial Information Users (FIUs) once the consent is given by the customer.

CDSL FIP provides financial information for the following FI types.

- Equity (EQ)

- Mutual Fund (MF)

- Exchange Traded Funds (ETF)

- Indian Depository Receipts (IDR)

- Collective Investment Schemes (CIS)

- Alternative Investment Funds (AIF)

- Units of Infrastructure Investment Trusts (INVIT)

- Units of Real Estate Investment Trusts (REIT)

CDSL has gone live with below AAs.

- CAMS Financial Information Services Pvt Ltd (CAMSfinserv)

- Cookiejar Technologies Private Limited (Products Titled Finvu)

- CRIF Connect Private Limited

- Dashboard Account Aggregation Services Private Limited (Product titled Saafe)

- FinSec AA Solutions Private Limited (Product titled OneMoney)

- NESL Asset Data Limited

- Perfios Account Aggregation Services Pvt Ltd (Product titled Anumati)

- Protean (formerly NSDL E-Governance Account Aggregator Limited) (Product titled Protean SurakshAA)

- Tally Account Aggregator Service Private Limited (Product titled TallyEdge)

- Unacores AA Solutions Private Limited (Product titled INK)

- Digio Internet Private Limited

- Agya technologies Private Limited

- OMS Fintech Account Aggregator Private Limited

To know more about FIP: https://sahamati.org.in/financial-information-provider-fip/

Process

Process:

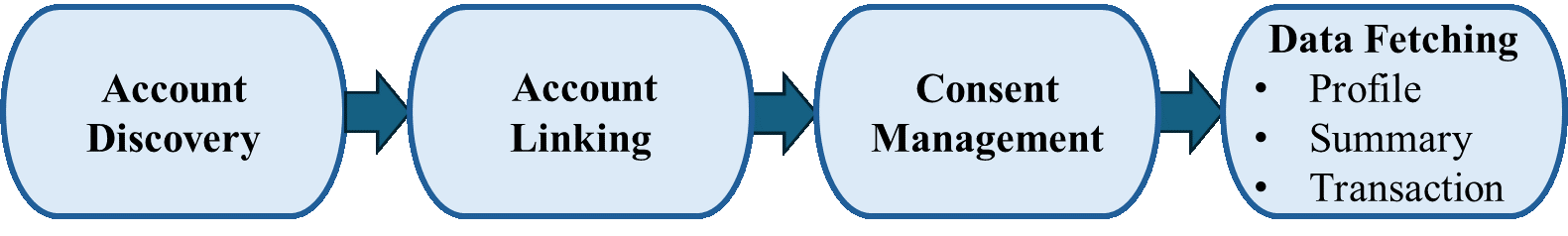

- Account Discovery: Customer registers on AA platform using Mobile + PAN registered in Demat accounts. He / She discovers his/hers CDSL account – FI Types.

- Account Linking: Customer links demat account - FI Type through OTP sent by CDSL FIP on AA platform.

- Consent Management:: Customer to approve consent sent by FIU to their AA ID with consent parameters (consent validity, consent type, Financial Information Data Range, Purpose code etc.)

-

FI data fetch flow:

FIU sends FI data request with consent ID to pull the data for below details:

- Profile:Customer personal details of the user including Name, Mobile Number, PAN, Demat Account number, etc.

- Summary:Portfolio Value, ISIN wise holdings for given FI type.

- Transaction:Transaction history for the given period for the given FI type.

Complaints/grievances

For any complaints/grievances regarding Account Aggregator, please raise a ticket on below link: https://support.sahamati.org.in/

Help

Queries regarding the FIP process may be sent to [email protected] or connect on (022 62343246/ 3242/3243).