eDIS

Introduction

At present, client’s authorization to debit its Demat account can be given in any one of the following ways:

a) Power of Attorney (POA)

b) Delivery Instruction Slip (DIS)

c) Electronic Instruction Platforms of Depository (easiest)

d) Electronic Instruction Platforms of Stock Brokers / Depository Participants (DPs) (eDIS)

Currently, CDSL has set up an electronic instruction platform. Beneficial Owners (Bos) or their POA holders can submit electronic instructions on the electronic instruction platform of the depository. CDSL has a facility called easiest. This facility is available on the internet in CDSL website as well as on CDSL mobile app called myeasi. These platforms allow electronic instructions to be given by a client anytime, anywhere.

Electronic instructions can also be submitted by clients using electronic instruction platform of CDSL DPs offering such facility.

The TPIN (Transaction Personal Identification Number) based mechanism for authentication of eDIS transactions by depository:

- A TPIN will be generated by the depository for each BO wishing to avail eDIS facility and will be communicated to the BO directly. The BO will have to enter the same TPIN every time it executes an eDIS. The stock broker / Depository Participant (DP) portal /mobile app will call for depository web-page for entry of TPIN to ensure confidentiality of the TPIN.

- As the TPIN is generated and communicated to the BO by the depository and is entered on the depository’s system at the time of authentication, the confidentiality of TPIN is ensured.

Process of Edis

1. Generation of TPIN:

i. For the DPs who are registered for e-DIS, depository shall generate TPIN number for their BOs. TPIN will be sent to the registered Mobile Number and Email ID of the BOs registered with the depository.

ii. A BO of registered DP will be able to change / regenerate a TPIN by submitting request to depository system.

iii. DPs will not have any control/access on TPIN i.e. visibility, edit or storing option

2. Generation of a API Key for a DP:

As a part of the registration of DP, the depository will generate API key which will be used (during) the communication by the DP with the Depository for authentication on eDIS portal.

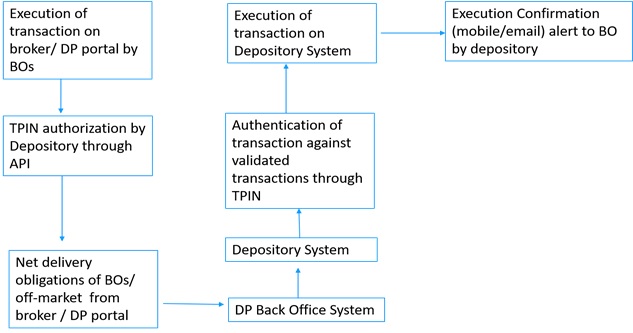

3. Transaction processing through stock broker / DP’s web-portal or mobile app

i. BO will access the Stock Broker / DP portal or mobile app using Login ID-Password and 2nd Factor Authentication. The login credentials will be checked and verified by the respective Stock Broker / DP.

ii. On entry of transactions, a provision of API will be made available to DP such that DP can call depository API and provide details of transactions in encrypted format to the depository webpage.

iii. The depository’s web page will be opened on the BO’s device, which will display the details of transactions entered by the client prompting client to confirm the details and further prompt to enter the TPIN provided by the depository.

iv. On confirmation by the BO and successful validation of TPIN, depository will store transaction details as validated transactions and send ‘success’ message to the DP or in case of unsuccessful validation of TPIN, send ‘ reject’ message to the DP.

v. Subsequently, DP will upload the transactions of the BO on the depository system. The depository will match the validated details against the details of such uploaded transaction and allow the transaction to go through, only if matched.

vi. The above process is similar to the process being followed for e-payments while doing e-commerce transactions wherein after choosing the merchandise to be bought, the customer is directed to the web-page of the bank to do payment. The authenticating parameters (e.g. passwords) entered on the bank web-site by the customer is not known by the e-commerce website. Successful payment is informed to the e-commerce website by the bank.